As a small business owner, you know that effective accounting is essential to the success of your company. But with so many different accounting software programs on the market, it can be difficult to know which one is right for you. Effective accounting software also facilitates financial data analysis, enabling businesses to make informed decisions based on accurate financial information.

That’s why we’ve put together this review of the best accounting software for small businesses. We’ll help you understand the features and benefits of each program, so you can make an informed decision about which one is right for your business.

This article outlines the best accounting software for your small business.

What is Accounting Software?

Accounting software helps companies keep track of their financial transactions, such as sales, purchases, expenses, and accounts payable. It also provides financial reporting on these transactions, allowing them to see how much money they have coming in and going out at any given time.

This information is used by accountants to prepare tax returns and other important documents. Additionally, accounting software facilitates financial data analysis, enabling businesses to make informed decisions based on accurate financial information.

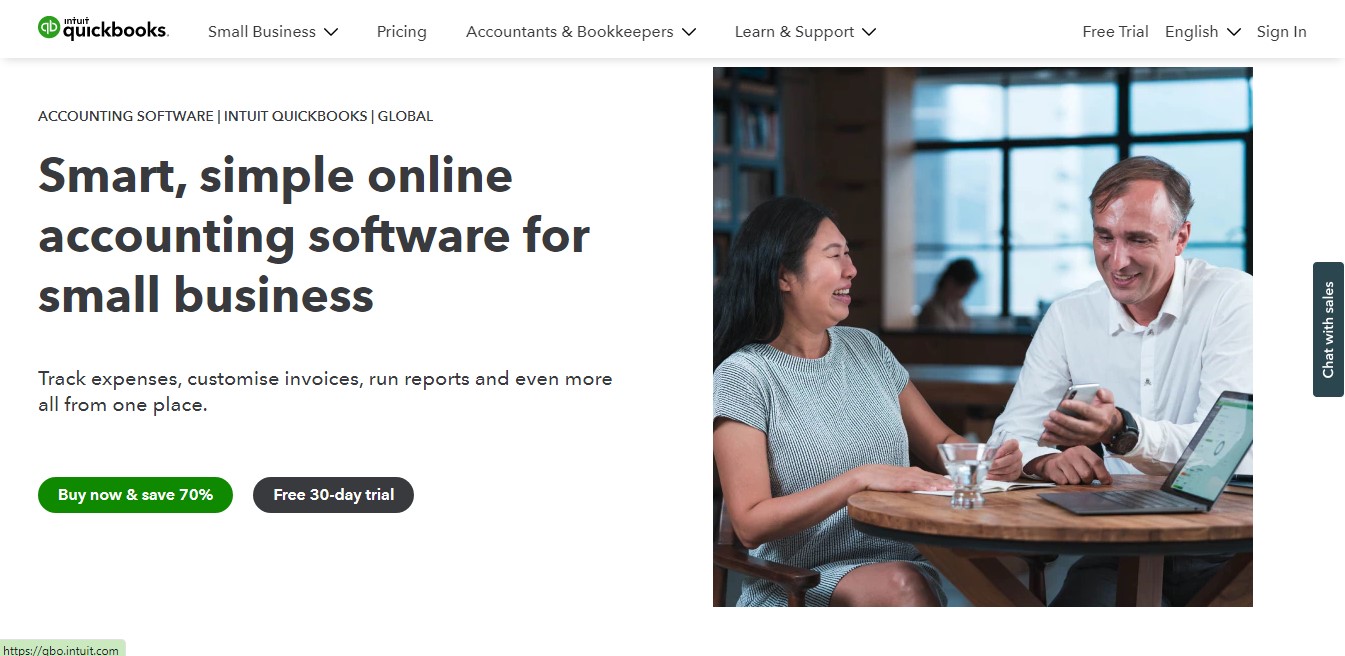

1. QuickBooks Online

QuickBooks Online is online accounting software used by small businesses and self-employed professionals. It allows users to track sales and expenses, manage invoices and customers, and create reports. QuickBooks Online also offers features such as tracking inventory, creating budgets, and managing payroll. QuickBooks also has a mobile accounting app available for Apple iOS devices.

QuickBooks Online is a double entry accounting software, which is essential for maintaining accurate finances by automatically entering debits and credits. QuickBooks Online also simplifies tax preparation by organizing your financial data and generating necessary tax documents.

With QuickBooks Online, you can monitor your income statements, balance sheets, cash flow, and profit margins from anywhere at any time. You can even access your financial information through your smartphone or tablet.

Key Features

You can access QuickBooks online from anywhere with an internet connection, which makes it convenient for busy entrepreneurs on the go.

The software is easy to use and navigate, even for those with little accounting experience.

Invoice creation is easy using templates, and you can customize them to fit your needs.

Simply use Quickbooks Online to run your cash flow statement, analyze your profit margin, and generate reports.

QuickBooks Online offers a variety of features and tools to help small businesses manage their finances effectively. One of these includes their mobile invoicing app.

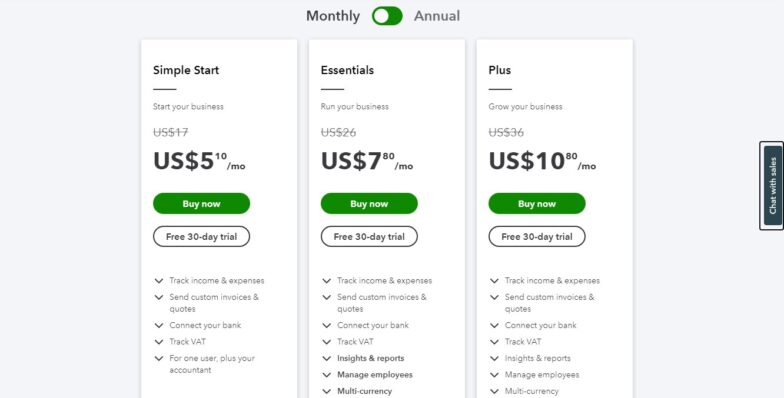

The software is affordable, with plans starting at just $5 per month.

QuickBooks Online integrates with some third-party apps and services, which makes it even more versatile and convenient to use.

QuickBooks Online allows you to accept online payments, enhancing the efficiency of invoicing processes. This capability enables users to receive payments faster and simplifies financial management, making it an essential tool for small businesses looking to improve their cash flow.

Pricing

QuickBooks online has a variety of pricing plans, depending on the needs of your business. The most basic plan starts at just $5 per month and includes features such as invoicing, tracking sales and expenses, creating reports, and managing customers. For businesses that need more advanced features, such as inventory management and budgeting, there are also pricier plans available. However, QuickBooks online is still very affordable compared to other accounting software options on the market.

Start your 30day free trial today

Try QuickBooks Online

2. Xero

Xero is online accounting software that connects small businesses with the financial tools and information they need to grow and thrive. Xero’s intuitive design and functionality make it easy for businesses to manage their finances, from invoicing and payments to tracking expenses and reporting. With Xero, businesses can save time on bookkeeping and focus on what they do best. Xero also supports financial planning, helping businesses set and achieve their financial goals.

Xero helps manage the financial health of small businesses by automating invoicing, expense tracking, and payment acceptance.

With Xero, businesses can save time on bookkeeping and focus on what they do best. Xero’s intuitive design and functionality make it easy for businesses to manage their finances, from invoicing and payments to tracking expenses and reporting. With Xero, businesses can save time on bookkeeping and focus on what they do best.

Key Features

Xero saves businesses time on bookkeeping so they can focus on what they do best

Xero’s intuitive design and functionality make it easy for businesses to manage their finances

With Xero, businesses can track expenses, invoicing, and payments easily

Xero helps businesses save money by providing financial tools and information needed to manage your business.

Xero Pricing

Xero has a variety of pricing plans to suit the needs of different businesses. The Starter plan is $9 per month and includes invoicing, payments, bank reconciliation, and reporting. The Standard plan is $30 per month and includes all of the features of the Starter plan, plus projects, inventory, and multi-currency.

The Premium plan is $60 per month and includes all of the features of the Standard plan, plus advanced reporting and forecasting. Xero also offers a 30-day free trial so businesses can try out the software before they commit to a paid plan.

Xero’s customer support team is available 24/7 to help businesses with any questions or issues they may have.

Try Xero

3. Fresh Books

FreshBooks is cloud-based accounting software designed specifically for freelancers, contractors, and independent service providers. The platform was built to simplify billing processes, streamline client interactions, and automate recurring tasks. With FreshBooks, you’ll be able to create professional-looking customizable invoices, send automated reminders about due dates, and track time spent on specific clients. FreshBooks also excels in expense management, allowing you to track and categorize your expenses effortlessly.

FreshBooks is another great option if you want a simple accounting system that will allow you to keep up with all of your financial transactions. The program lets you send invoices, accept payments, track clients, create estimates, and much more. You can choose between an annual subscription or a pay-as-you-go model.

The FreshBooks mobile accounting app allows you to access your data wherever you go. FreshBooks makes it easy to bill clients, organize your work, and get paid.

If you’re like most small business owners, you didn’t get into business to do paperwork. You got in the business to do what you love. But the thing is, paperwork and accounting are a necessary evil when it comes to running a successful business. FreshBooks makes accounting easy, so you can focus on the things you love.

Key Features

Tracking finances and creating invoices is simple and easy to do including a chart of accounts.

Automated reminders for due dates.

Expense management and categorization.

Time tracking for specific clients.

Customizable invoices.

Key Features

Tracking finances and creating invoices is simple and easy to do including a chart of accounts

An easy-to-use user interface for everyone without experience

Integrating with other software makes bookkeeping a breeze

The mobile app is convenient and user-friendly

Inventory tracking is included

You can use multiple currencies

Customer support is always available to help with any questions or concerns you may have.

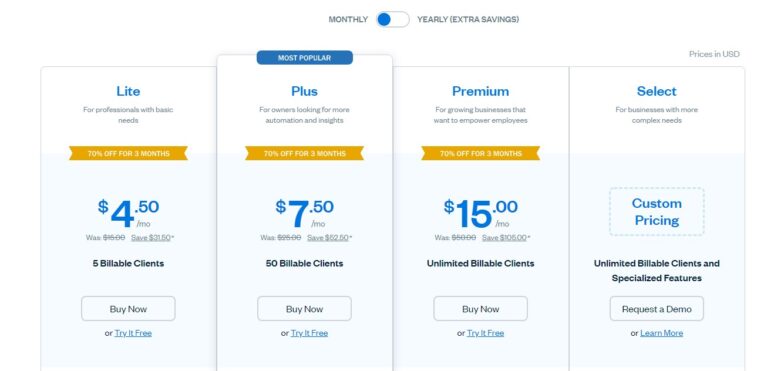

Fresh Books has several different pricing plans to suit the needs of any business, starting at just $15/month. And if you’re not quite sure if Fresh Books is right for you, they offer a free 30-day trial so you can try it out before committing to anything.

If you’re ready to streamline your accounting and get back to doing what you love, sign up for Fresh Books today.

4. Zoho Books

Zoho Books is an online accounting software used by businesses to manage their finances. Zoho Books lets users track invoices, create and send bills, reconcile bank transactions, and more. With Zoho Books, business owners can save time on bookkeeping and focus on growing their business. Zoho Books also generates comprehensive financial statements, providing a clear picture of your business’s financial status.

Zoho Books is one of the best options for small business owners who need a simple yet powerful accounting solution. It’s easy to set up and use, making it perfect for beginners. Plus, there are no upfront costs associated with using this software.

Accounting Features

Some benefits of using Zoho Books include:

Save time on bookkeeping: With Zoho Books, businesses can automate tasks like invoicing and bill payments, so they can spend less time on bookkeeping and more time on growing their business.

Get a better understanding of finances: Zoho Books provides users with insights and reports on their financial data, so they can make informed decisions about their business.

Stay compliant with taxes: Zoho Books helps businesses stay compliant with tax regulations by providing features like tax calculation and filing.

Calculate sales tax automatically: Zoho Books includes features that help businesses calculate sales tax during sales transactions, streamlining the invoicing process and enhancing overall financial tracking.

Collaborate with team members: Zoho Books lets businesses invite team members to collaborate on financial tasks. This way, businesses can have multiple people working on their finances

Zoho Books has a free plan for businesses with limited needs and paid plans starting at $9 per month. Paid plans include additional features like multi-currency support, advanced reporting, and more. Zoho offers a fully featured 14-day free trial.

Try Zoho Books for free today and see how it can help your business manage its finances.

5. Wave Accounting

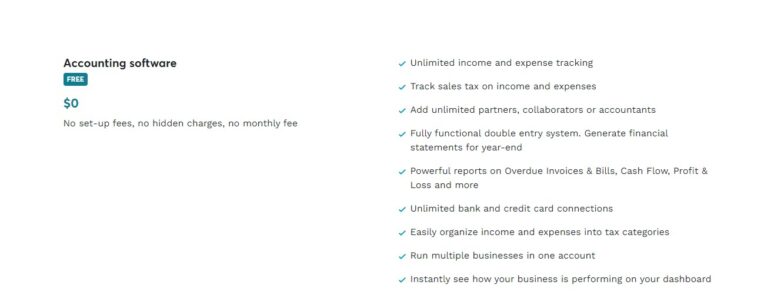

Wave Accounting is a free online accounting software that helps small businesses manage their finances. Wave Accounting allows users to track income and expenses, create invoices and estimates, reconcile bank transactions, and much more. Wave Accounting is an ideal solution for small businesses that need simple and easy-to-use accounting software. Wave Accounting also simplifies account reconciliation, ensuring your financial records are accurate and up-to-date.

Some benefits of using Wave Accounting include:

Keeps records organized: Wave Accounting automatically sorts all of your financial information into categories, which makes it easier to keep your books in order.

Easy to learn: The interface is intuitive and straightforward, making it easy for new users to navigate.

Simple setup: You don’t need to do any complex installation or configuration. All you need to do is log in to start using Wave Accounting.

Free: There are no hidden fees when using Wave Accounting.

Accounting Features

Some of the benefits of using Wave Accounting include:

Free to use – Wave Accounting is free to use, which makes it an affordable option for small businesses.

Easy to use – Wave Accounting is easy to use, even for those with no accounting experience. The software is intuitive and user-friendly.

Track income and expenses – Wave Accounting helps businesses track their income and expenses, so they can stay on top of their finances.

Create invoices and estimates – Wave Accounting makes it easy to create invoices and estimates, so businesses can save time on billing.

Reconcile bank transactions – Wave Accounting can reconcile bank transactions, so businesses can be sure they are keeping accurate financial records.

Wave Accounting is a great solution for small businesses that need simple and easy-to-use accounting software. With Wave Accounting, businesses can save time and money while staying on top of their finances.

Pricing

Wave Accounting is a free online accounting software, which makes it an affordable option for small businesses. There are no monthly fees or subscription charges, so businesses only have to pay for the features they use. For businesses that need additional help, Wave Accounting offers affordable pricing tiers that include expert support and advanced features.

Some of the features included in the paid plans are:

Expense tracking – Track business expenses and see where money is being spent.

Invoice and estimate creation – Create invoices and estimates faster and easier.

Bank reconciliation – Reconcile bank statements and transactions.

Financial reports – Generate reports to track income

You can try out Wave Accounting for free for 30 days. After that, you will be charged $29 per user per year.

6. Sage 50cloud Accounting

Sage 50cloud Accounting is a cloud-based accounting software designed specifically for small businesses. It gives businesses access to all their financial information from anywhere, anytime. Sage 50cloud Accounting is perfect for small businesses because it provides them with everything they need to run their company efficiently. Sage 50cloud Accounting also offers comprehensive financial management tools, helping you oversee all aspects of your business’s finances.

Key Features

Some of the key features of this software include:

Access to all data – Sage 50cloud Accounting lets you view all your financial data from any device. You can easily access your accounts from anywhere, including mobile devices.

Simple setup – Setup is quick and easy. All you need to do is log in to your account and start managing your finances.

Project management and project tracking through their job management feature

QuickBooks Online integration – Sage 50cloud Accounting integrates with QuickBooks Online, so you can sync your data between both systems. This means you don’t have to worry about losing important documents when switching companies.

Advanced reporting tools – Sage 50cloud Accounting has many useful reporting tools that allow you to generate customized reports based on specific criteria. These reports will help you keep up with your finances.

Pricing

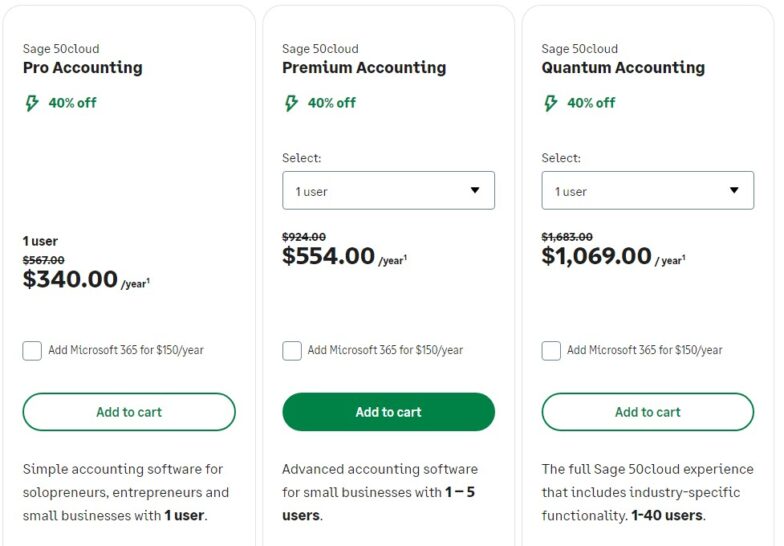

The basic plan (Pro Accounting) includes 1 user, and goest for $340/year with, Invoice and bill tracking, Purchase order and approval, Expense management, Automated bank reconciliation, Reporting (Financial Statements, Cash Flow, General Ledger), Payroll-ready, Inventory management (manage stock, create assemblies, FIFO/LIFO costing)and Job management and job costing. The plan also includes Sage Security Shield (business identification theft & cyber protection).

The Premium accounting plan goes for $554/year and allows you to add more users (1-5)and increase and gives you more features. The Quantum Accounting plan adds up to 40 user licenses and has no limit to the number of features. It gives you the full Sage 50Cloud Experience.

The current prices show that users save 40% in the first year. The prices share here are with a 40% discount.

What are the Different Types of Accounting Software?

There are three main types of accounting software: desktop-based, cloud-based, and mobile-based. Desktop-based solutions require users to install the software on their computers, while cloud-based solutions allow users to work from anywhere using a web browser. Mobile-based solutions are available through smartphones and tablets. Each type of accounting software offers various features, including financial reporting, to help businesses manage their finances effectively.

Double entry accounting is crucial in providing a comprehensive and precise bookkeeping solution, ensuring all financial transactions are accurately recorded and balanced.

Desktop-Based Solutions

Desktop-based accounting software typically includes all the basic functions required by most small business owners. However, these programs tend to be very complex, which makes them difficult to use. They often come with a large price tag, making them out of reach for most small businesses.

Cloud-Based Solutions

Cloud-based accounting software offers a lot of benefits. Users can access their data from any computer or smartphone, and they can make changes without having to reenter information. In addition, cloud-based solutions provide security and reliability because they store data online rather than on individual devices.

Mobile-Based Solutions

Mobile-based accounting software is ideal for those who want to manage their finances from anywhere at any time. Some of the best examples of mobile-based accounting software are Intuit GoPayment, Square, and Stripe.

Why Every Small Business Owner Needs Accounting Software

If you’re a small business owner, chances are you wear a lot of hats. You’re responsible for everything from marketing and sales to operations and finance. And while you might be an expert in some areas, odds are accounting isn’t one of them.

Accounting software helps you keep track of your financial transactions. This way, you can easily see how much money you have coming into and going out of your business. You can also determine whether you are spending too much or not enough. Accounting software also facilitates financial analysis, enabling you to make data-driven decisions for your business.

In addition, accounting software will help you prepare accurate reports. These reports are essential for keeping you informed about your business performance. For example, you can use accounting software to generate profit and loss statements, balance sheets, cash flow statements, and income tax returns at affordable prices.

That’s why it’s so important to have good accounting software in place. It can help you keep track of your finances, invoicing, and more.

There are a lot of different accounting software programs out there, so how do you know which one is right for your business? Here are a few things to look for:

Ease of use: You don’t want to spend hours trying to figure out how to use your accounting software. Look for a program that is user-friendly and easy to navigate.

Features: Make sure the accounting software you choose has all the robust features you need, such as customizable invoicing, expense tracking, and reporting.

Price: Don’t overspend on accounting software. There are a lot of great programs out there that are affordable.

If you’re not sure which accounting software to choose, ask your accountant or bookkeeper for recommendations. They’ll be able to help you find a program that fits your specific business needs.

How to Choose the Right Accounting Software for Your Small Business

As a small business owner, you have enough to worry about without having to keep track of your finances on top of everything else. That’s where accounting software comes in. This type of software can help you save time and money by keeping track of your financial transactions for you. Effective financial management is crucial for the success of your business, and the right accounting software can help you achieve this.

But with so many different accounting software programs available, how do you know which one is right for your business? Here are a few things to consider when choosing accounting software for your small business:

Ease of use: You don’t want to spend hours trying to figure out how to use your accounting software. Look for a program that is user-friendly and easy to navigate.

Functionality: Make sure the accounting software you choose has all the features you need. For example, if you need to track inventory, choose a program that includes this functionality.

Cost: Don’t break the bank on accounting software. There are plenty of affordable options available that will do the job just fine.

Compatibility: Make sure the accounting software you choose is compatible with your computer’s operating system.

Customer support: If you run into any problems using your accounting software, you’ll want to be able to get help from a customer support team. Look for a program that offers 24/7 customer support in case you have any questions or issues. By considering these factors, you can narrow down your choices and find the best accounting software for your small business.

Frequently asked questions

The main reason why we use accounting software is to make our life easier. We know it sounds cliché, but when you’re running a small business, every hour counts. And not only does accounting software allow us to manage our finances more efficiently, but it also helps us stay organized. So, let’s take a look at some frequently asked questions about accounting software.

What is the most widely used accounting software?

There is no one “most widely used” accounting software. Different businesses have different needs, so there is no single accounting program that is used by all businesses.

Instead, businesses should choose accounting software that meets their specific needs. There are many different accounting software programs available, so be sure to do your research to find the best one for your business. Many widely used accounting software programs offer robust financial reporting features to help businesses stay on top of their finances.

What software would Accountants use?

There is no one software that all accountants use. Instead, accountants should choose software that meets their specific needs. There are many different accounting software programs available, so be sure to do your research to find the best one for your business.

What’s the best way to keep track of inventory?

The best way to track inventory depends on how much inventory you have and what type of inventory it is. For example, if you have only a few products, then you may not need an inventory management tool. However, if you have hundreds of thousands of items, then you will want to invest in an inventory management tool.

You also need to consider whether you want to manage inventory from a desktop or mobile device. Desktop computers tend to be more expensive than mobile devices, but they offer better performance. Mobile devices are typically less expensive, but they don’t always provide the same level of functionality as desktop computers.

How do I get started using accounting software?

The first step is to determine which software works best for your business. This means looking at your business’s unique needs and deciding which software will work best for those needs. Once you’ve determined which software will meet your needs, you’ll need to decide where to buy the software. Some online retailers sell accounting software directly through their websites; others sell the software through third parties. If you purchase the software from a third party, make sure that the company provides good customer service and has a reliable return policy.

What program do most bookkeepers use?

There is no one “most widely used” bookkeeping software. Different businesses have different needs, so there is no single accounting program that is used by all businesses. Instead, businesses should choose accounting software that meets their specific needs. There are many different accounting software programs available, so be sure to do your research to find the best one for your business.

What is the most popular accounting software for small businesses?

There is no one “most popular” accounting software for small businesses. Different businesses have different needs, so there is no single program that is used by all businesses.

Which is the best free accounting software?

There is no one “best” free accounting software. Different businesses have different needs, so there is no single program that is used by all businesses. Instead, businesses should choose accounting software that meets their specific needs. There are many different accounting software programs available, both paid and free, so be sure to do your research to find the best accounting solution for you.

Do I need an accountant if I use QuickBooks?

No. You don’t need an accountant to run QuickBooks. However, it’s always good practice to hire an accountant when running a business because they will help you avoid common mistakes.

How much does it cost to set up an accounting software?

It depends on what type of accounting software you want to buy. If you’re looking at using a cloud-based accounting system like Xero or Wave, then this might not be as expensive as you think. Some companies offer free trials of these types of systems. On the other hand, if you’re looking into buying a desktop-based accounting program, then expect to pay more than $100 per month.

Is it possible to learn how to use accounting software?

Yes. Most business accounting software comes with tutorials that teach you how to use the software. It’s also easy enough to search online for videos that show you how to use each feature in your accounting software.

What is the simplest accounting software?

The easiest accounting software is probably Quicken Basic. This is a simple accounting program that can handle basic tasks such as entering transactions and generating reports. However, it won’t give you access to advanced features such as creating invoices and managing payroll

Is QuickBooks easy to learn?

Yes. QuickBooks has several training options, including a 30-minute tutorial that teaches users how to navigate through the software. Once you’ve completed the tutorial, you’ll receive a user manual that explains how to use every part of the program.

Is QuickBooks a good accounting program?

QuickBooks is a great accounting program for small businesses. The program offers everything you need to manage your finances, but it doesn’t include any extra bells and whistles. For example, QuickBooks doesn’t allow you to create custom forms or customize reports. However, QuickBooks is very easy to use and provides plenty of support from Intuit QuickBooks.

How Can Accountants Help Me With My Bookkeeping?

Bookkeepers are trained professionals who specialize in bookkeeping. They know how to organize your books so that it is easier for you to understand. They can also assist you with setting up new accounts, reconciling bank accounts, and preparing reports.

Bookkeepers can also help you identify areas where you could improve your business operations. They can find ways to reduce costs, eliminate errors, and streamline processes.

In Summary: The Best Accounting Software

If you’re a small business owner, the right accounting software can save you time and money. There are may are some different types of accounting software. Some are designed specifically for businesses while others are geared toward individuals. Either way, they can make managing your finances much easier. To find the perfect accounting software for your business, consider these tips:

Look for an accounting software program that is user-friendly with all the features you need, such as invoicing, expense tracking, and reporting. Don’t overspend on accounting software – there are plenty of affordable options available.

Make sure the software you choose is compatible with your computer’s operating system and offers customer support in case you have any questions or issues. By considering these factors, you can find the best accounting software for your small business.

Accounting software can save small business owners time and money.

Look for a user-friendly program with all the features you need, such as invoicing, expense tracking, and reporting.

There are plenty of affordable accounting software options available.

Make sure the software you choose is compatible with your computer’s operating system and offers customer support in case you have any questions or issues.

If you’re a small business owner, the right accounting software can save you time and money. Look for a user-friendly program with all the features you need, such as invoicing, expense tracking, and reporting. Don’t overspend on accounting software – there are plenty of affordable options available.

Make sure the software you choose is compatible with your computer’s operating system and offers customer support in case you have any questions or issues. By considering these factors, you can find the best accounting software for your small business.

Frequently Asked Questions

What is the most commonly used accounting software?

QuickBooks Online is one of the most commonly used accounting software among small businesses due to its comprehensive features, user-friendly interface, and ability to integrate with third-party apps.

What is the simplest accounting software?

Wave Accounting is often considered one of the simplest accounting software options available, especially for small businesses and freelancers looking for basic bookkeeping solutions without a steep learning curve.

Which software is best for an accountant?

For accountants, software like Xero and QuickBooks Online are popular choices because they offer robust features, including advanced reporting, multiple user access, and seamless integration with other financial tools.

Is Excel an accounting software?

While Excel is not specifically designed as accounting software, it is often used for accounting purposes due to its ability to handle spreadsheets and perform calculations. However, it lacks the specialized features of dedicated accounting software like QuickBooks or Xero.

Why should small businesses use accounting software?

Small business accounting software helps streamline financial management, automate tasks, track income and expenses, and generate reports, ultimately saving time and reducing errors in financial records.

Can accounting software help with tax preparation?

Yes, most accounting software can assist with tax preparation by organizing financial data and generating necessary tax documents, making tax season less stressful for small business owners.

What are some key features to look for in accounting software?

Look for features like invoicing, expense tracking, bank reconciliation, financial reporting, and the ability to accept online payments. These features can greatly enhance your business’s financial management.

How does double entry accounting software benefit small businesses?

Double entry accounting software ensures accuracy in financial records by automatically recording debits and credits, helping small businesses maintain balanced books and better understand their financial health.