Cloud adoption is significantly transforming businesses at every level. The cloud has become the de facto standard for data storage, application development, and infrastructure management.

Gartner says that by 2026, more than 45% of IT spending on system infrastructure, infrastructure software, application software, and business process outsourcing will shift from traditional solutions to the cloud.

There are many reasons why businesses choose to use cloud services instead of using local servers. From cost savings to improved security, there are plenty of advantages to choosing cloud solutions over traditional ones.

This article aims at providing data about statistics in cloud adoption across multiple countries to prove that cloud adoption is only going to increase.

Introduction to Cloud Computing

Cloud computing refers to delivering computing services over the internet, where resources such as servers, storage, databases, software, and applications are provided as a service to users on-demand.

This allows businesses and individuals to access and utilize these resources without the need for physical infrastructure, reducing costs and increasing flexibility.

The global cloud computing market has experienced significant growth in recent years, with public cloud services such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) leading the way.

These platforms offer a wide range of services that cater to various business needs, from data storage and computing power to advanced analytics and machine learning capabilities.

As the adoption of cloud computing continues to rise, it is reshaping the IT landscape and driving innovation across industries.

1. By 2022, more than $1.3 trillion in IT spending will be impacted by the move to the cloud.

Gartner suggests that technology providers should use indications of growth in cloud adoption to indicate market opportunities.

They classify the cloud computing market into four categories: system infrastructure, infrastructure software, application software, and business process outsourcing, with significant cloud investment driving these shifts.

The largest shift in IT spending is in application services – 36% of companies that have used another method to host their applications have switched to the cloud.

The biggest change in system infrastructure in 2019 was the smallest portion with just 13%. In 2022, the application software will be most important, accounting for 40% of the total market share, while system infrastructure will shift toward cloud solutions, accounting for 20%.

2. 66% of enterprises have already established a central cloud team or center of excellence.

Another 21% plan to have one soon, too.

The main responsibilities of these central IT departments shape up to be optimizing cloud costs (for 68% of enterprises), figuring out which applications should run on which cloud (for 62%), and finally – setting policies for cloud use (for 59%).

3. 94% of enterprises use the cloud.

According to Right Scale’s annual State of the Cloud Report for 2019, 91% of businesses used a public cloud and 72% used a private one. Most enterprises use both public and private clouds, with 69 percent choosing a hybrid cloud solution.

Cloud adoption trends indicate that companies should use both public and private clouds for greater flexibility and a variety of options. Only 22% of companies use the public cloud exclusively. And only 3% of companies use a private cloud exclusively.

Cloud Usage Statistics

4. Data reveal that in 2020 a staggering 83% of the companies’ workload was stored on the cloud.

A notable detail here is that a growing number of companies will be moving from a private to a public cloud.

This attests to the claims that even though the public model gives you less control, you can still enjoy optimum security and ease of access.

5. Cloud Adoption in the EU is at 46% in 2022.

Cloud adoption has been slow in Europe as a whole. Only 42% of European enterprises used cloud computing in 2021 – mainly for email hosting and file storage. However, this is an enormous increase from the previous year’s figure of 36%.

European companies find the cloud a suitable place to run their financial, accounting, and customer relationship management (CRM) software.

Public cloud services receive more attention (18%) from European companies than their private counterparts ( at 11%). 68% of cloud users use these services for storing files; 48% find them a suitable place to host their databases; and 53% report using them for office software.

The numbers varied significantly across member states. At least 40 percent of enterprises in Finland, Denmark, the Netherlands, Ireland, the United Kingdom, and Belgium use cloud computing.

Sweden has the highest percentage of cloud adoption at 75%, while only less than 13% percent of businesses rely on cloud services in Bulgaria and Romania.

6. Cloud adoption in Asia-Pacific is showing great progress. Only 10 percent of businesses are yet to realize its benefits.

Cloud adoption in the Asia-Pacific region is showing great progress, with only 10 percent of businesses yet to realize its benefits.

Most businesses in the region (more than 90%) use, or plan to adopt, a multi-cloud environment (either a hybrid or a fully integrated hybrid). 52% of those either currently use a fully integrated hybrid or are planning to use one.

It helps them establish consistency regarding their security policies and reduces the total cost. It also gives them more flexibility when responding to changing requirements.

More than half of enterprises focus on moving workloads from their internal environment to the public cloud. Another 28 percent are focusing on a lift-and-shift approach, while another 28 percent are undergoing refactoring first.

A slight majority of enterprises (55%) will use the help of a service provider to execute their hybrid cloud plans. They will rely on their cloud service provider either during the deployment or migration (21%) or for ongoing operations (35%).

Security is the primary concern when making hybrid cloud decisions. More than half (56%) say it’s critical and a hard requirement. Only 5% consider security not to be an issue at all.

7. North America and APAC are the Regions adopting Fastest

According to ReportLinker, North America is the most mature market in cloud computing services adoption.

The analysts believe that North America’s position is due to several factors including the presence of various companies with more advanced IT infrastructures and the availability of IT expertise.

Asia Pacific (APAC) is also expected to offer huge growth opportunities for cloud computing companies between the period of 2021 and 2026.

Growth in these areas could be particularly significant with the arrival and adoption of new technologies like IoT.

Cloud Adoption for Enterprises

8. Companies waste up to 30% of their cloud spend

Cloud spending seems to be a major issue for many companies, particularly as cloud prices and investments continue to rise.

Respondents estimate that around 30% of cloud spending is wasted at present in their companies.

Cloud spending wastage could be caused by companies rushing into the cloud without having a full plan for their cloud strategy and understanding the full potential of cloud capabilities in 2022.

9. 70% of the companies that offer financial services are still in the early stages of cloud adoption.

Financial services lag behind most other sectors when it comes to adopting new technologies, with about 70% of organizations currently in the trial and testing phase of their cloud migration projects.

They’re already planning for the future by having clear strategies in place. 60% percent of all businesses in the industry expect their IT environment to integrate both on-premises cloud infrastructure and externally hosted cloud infrastructures.

Only 18% of respondents say they will solely rely upon the public cloud.

Companies still expect to handle most of their workloads internally – using one or several private cloud solutions. Experts also agree that a multi-cloud architecture will help with application security (62%), meet regulatory requirements (43%), and reduce costs (40%).

Despite the apparent reluctance to adopt the cloud, businesses in financial services show higher cloud adoption rates than overall surveys.

For public infrastructure as a service (IaaS) (52% to 45%), on-premises Private Cloud (50% to 41%) and Platform as a Service (PaaS) (41% to 32%).

10. Thirty-seven percent of enterprises said their annual spending exceeded $12 million.

Increasingly, organizations of all sizes are turning to the public cloud to power their applications.

Public cloud spending is now a major line item in IT budgets, and public cloud spending has grown significantly.

According to Gartner, 37% of enterprises said their annual budget exceeds $12 million, and 80% reported that cloud spending exceeds US$1.2 million per annum.

Smaller companies tend to run fewer and smaller workloads, so it stands to logic that their cloud bills would also tend to be lower. However, 53 percent SMBs spend more than 1.2 million dollars—up from 38 percent in 2017.

11. Cost-cutting tops the list of the reasons why enterprises choose to adopt the cloud.

Among 166 IT leaders surveyed, there were various reasons why enterprises might decide to move their computing to the Cloud. The most popular reason ( at 61%) for cutting costs is the company’s cost-cutting initiative.

The second reason ( at 57%) is the desire for new features or capabilities.

For 30% of companies, their current warehouse filling has pushed them toward adopting cloud computing.

About 23% of enterprises simply cite “executive mandate” as a reason, and only 12% of them have cited any other reason at all.

12. AWS, Microsoft, and Google are the Biggest Cloud Vendors.

According to a recent O’Reilly study in 2021, around 90 percent of respondents are using the Cloud regularly, up slightly from 88 percent in 2020. The response to the question was worldwide, with all continents except for Antarctica responding.

When comparing the most popular cloud providers, Amazon Web Services held 62 percent of the market, while Google Cloud Platform held 48 percent.

Alibaba Cloud is also a significant player in the global IaaS market, known for its rapid growth and substantial market share, particularly in the Asia-Pacific region. Google was following up in third place with 33%.

However, O‘Reilly pointed out that Amazon’s market share has declined slightly, but its dominance is still clear.

13. 51% of companies have all applicable infrastructure in the cloud.

Cloud adoption is increasing at an unprecedented rate, according to figures produced by RackSpace in 2021. A cloud computing company recently surveyed 1400 executives and found that around 51% have all their relevant infrastructure residing in the cloud.

Of the remaining 49 percent who are still making the move from on-premises to the cloud, most plan to move as much as possible of their IT infrastructure to the cloud as soon as they can.

Furthermore, two-thirds of respondents said theirs compute workload is supported by managed hosting services, the public cloud, or colocation tools.

14. Enterprises are becoming more proficient in using cloud technology.

Of the companies surveyed, 50% spent between $1.2M and $2.4M annually, while another 38% spent more than $2.4M. Most companies use a multi-cloud strategy, with 84 percent relying on one cloud provider.

This is an increase from 2018 when it was 81% between 2018 and 2019, the Hybrid cloud strategy also grew from 51% to 58%.

Looking at the current state of cloud adoption, there will be an increase compared to last year.

The proportion of enterprises at the intermediate and advanced stages increased from 66% in 2018 to 68% in 2019. The number of enterprises at the beginner level has dropped from 19% to 16%.

Enterprises are becoming increasingly aware of the industry, even though most of them haven’t yet taken any action.

Business With Cloud Infrastructure

Also known as “AWS,” Amazon’s cloud division has been the cloud market leader for several years. It was launched in 2006, and only offered one service, now the company offers over 140 services to its clients.

Amazon Web Services is widely used by many organizations because it offers a wide variety of services that improve business agility while remaining secure and reliable.

One of AWS‘s most popular services is Amazon Elastic Compute Cloud (EC2), which allows customers to create virtual machines for their business needs.

A fascinating fact is that AWS accounts for 13% of Amazon’s total sales.

In the fourth quarter of 2021, AWS was the most popular cloud infrastructure service provider, controlling 33 percent of the overall market. Microsoft Azure has a 22 percent market share, while Google Cloud has a nine percent market share.

These three cloud vendors together accounted for 64 percent of total cloud spending in the fourth quarter of 2021. Organizations use cloud services provided by these companies for machine learning, data analysis, cloud-native development, application migration, and others.

16. The global cloud computing market is expected to reach $623.3 billion by 2023.

The global cloud computing market size is expected to grow from USD 272.0 billion in 2018 to USD 623.3 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 18.0% during the forecast period.

The major growth factors for the cloud computing market are increased automation and agility, the need to deliver enhanced customer experience, and increased cost savings and return on investment. However, data prone to cyber-attacks and a lack of skilled labor may restrain its growth.

17. The average business runs 38% of workloads in public and 41% in the private cloud.

Usually, enterprises run a more significant part of their workloads in a private cloud (46%) and a smaller portion (33%) in the public cloud infrastructure.

Small to medium businesses, on the other hand, prefer to use a public cloud (43%), instead of arguably more expensive private solutions (35%).

According to cloud computing statistics, public cloud spending is growing at a rate three times faster than private clouds.

Experts predict that the gap between the two will continue to widen.

Benefits of Cloud Computing

The benefits of cloud computing are numerous, including cost savings, increased scalability and flexibility, improved collaboration and productivity, and enhanced security and reliability.

Cloud computing also enables businesses to quickly deploy and scale applications, reducing the time and effort required to bring new products and services to market.

Cloud computing provides access to emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), allowing businesses to stay competitive and innovative.

According to a recent survey, 85% of companies worldwide will adopt a cloud-first principle by 2025, with 95% of new digital workloads being developed on cloud-native platforms.

This shift towards cloud-first strategies highlights the growing recognition of the cloud’s potential to drive business transformation and growth.

Cloud Strategy and Security

Developing a comprehensive cloud strategy is crucial for businesses to ensure successful cloud adoption and minimize risks.

This includes assessing cloud readiness, defining cloud governance and security policies, and selecting the right cloud service providers. Cloud security is a top concern for businesses, with data breaches and cyber attacks on the rise.

To mitigate these risks, businesses must implement robust cloud security measures, such as encryption, access controls, and monitoring tools.

A hybrid cloud approach, which combines public and private clouds, can also provide greater security and control over sensitive data.

By leveraging the strengths of both public and private clouds, businesses can achieve a balanced and secure cloud environment that meets their specific needs and regulatory requirements.

Cloud Data Storage

Cloud data storage refers to the storage of data in a cloud computing environment, where data is stored, managed, and retrieved over the internet.

Cloud data storage provides numerous benefits, including scalability, flexibility, and cost savings.

Businesses can choose from a range of cloud storage options, including public cloud storage services such as AWS S3, Azure Blob Storage, and Google Cloud Storage.

Private cloud storage services, such as those offered by IBM Cloud and Oracle Cloud, can also provide greater security and control over sensitive data.

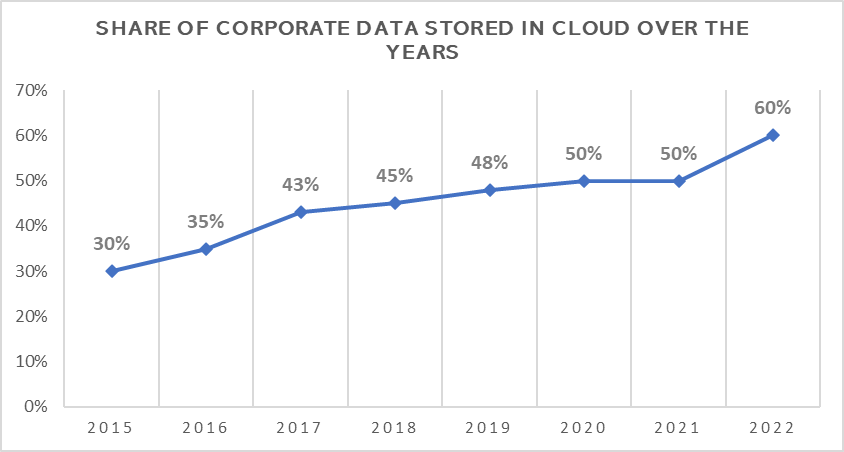

According to a recent report, more than half of corporate data is now stored in the cloud, with this trend expected to continue in the coming years.

As businesses increasingly rely on cloud storage solutions, they can benefit from improved data accessibility, disaster recovery capabilities, and reduced infrastructure costs.

Cloud Platforms and Services

Cloud platforms and services refer to the range of services and tools provided by cloud service providers to support cloud computing.

These include infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS) offerings, as well as specialized services such as data analytics, artificial intelligence, and machine learning.

Cloud platforms and services can be used to support a wide range of applications and use cases, from customer relationship management (CRM) and enterprise resource planning (ERP) to data warehousing and analytics.

The global cloud computing market is expected to reach $1.6 trillion by 2030, with the cloud services market expected to grow at a compound annual growth rate (CAGR) of 17.43% through 2032.

This rapid growth underscores the increasing importance of cloud platforms in driving digital transformation and enabling businesses to harness the power of advanced technologies.

Future of Cloud Adoption

18. The global Cloud Technology Market in the Healthcare Industry is forecasted to grow by $25.54 Billion in 2020-2024.

Cloud technology adoption has increased significantly over the past few years. According to a recent Technavio report, the global cloud market for healthcare is expected to reach $25.54 billion from 2020 to 2024. The ongoing pandemic has reinforced that growth.

19. According to Gartner, more than half of enterprise IT spending in key market segments will shift to the cloud by 2025.

Only those enterprises that can transition to the cloud within the application software, infrastructure software, business process services, and system infrastructure markets were included in Gartner’s “Cloud Shift” research, highlighting the critical role of cloud decision makers in this transition.

By 2025, 51 percent of IT spending in these categories will be shifting from traditional solutions to public clouds, compared to 41 percent in 2022. By 2025, almost two-thirds (65 percent) of spending on application software development will be directed toward cloud technology, up from 57.5 percent in 2022.

20. By 2025, the amount of data stored on cloud servers will surpass 100 Zettabytes.

Predictions about data usage are notoriously inaccurate. They tend to underestimate just how fast modern technology has developed. However, one educated guess estimates that there will be 200 zettabytes of data stored in computers, and 100 zettabytes of data will be stored on cloud servers.

21. The Cloud Computing Market will be worth $1251.09 billion by 2028.

According to research by Grandview Research, the global market for cloud computing is expected to grow at a compound annual growth rate (CAGR) of around 19.1 percent between 2021 and 2028 for cloud technology. According to Grandview Research, this will lead to an estimated $1.25 trillion valuation for the cloud by 2028.

The report notes that the growth of cloud adoption has come from a variety of factors, including rapid digital transformation in virtually every industry. Furthermore, the rise of new technologies like the Internet of Things (IoT), 5G, and Artificial intelligence (AI) is placing more focus on cloud flexibility.

Takeaways

Hopefully, these statistics for 2025 have given you a great idea of how cloud adoption in the market is growing.

With more companies making the transition to digital-first business models, the adoption of cloud computing will undoubtedly continue to grow.

Companies that wish to expand their reach need to take advantage of what cloud computing has to offer.

Frequently Asked Questions

What is the first step of cloud adoption?

The first step is understanding which on-premises apps are the best candidates for migrating to, or developing in, the cloud. This decision should be made based on usage trends and the business impact they have.

What is cloud adoption and migration?

Any enterprise-scale adoption plan involves workloads that don’t require significant investments in the creation or modification of existing business logic.

You could move these workloads to the cloud through any of several approaches: lift and shift (moving workloads from one location to another), lift and optimize (optimizing an existing workload for use in the cloud), or modernize (creating new workloads). Each approach is considered a migration.

What are the benefits of the cloud?

Benefits of cloud computing:

- Reduced IT costs.

- Scalability.

- Business continuity.

- Collaboration efficiency.

- The flexibility of work practices.

- Access to automatic updates.

What are the 4 types of clouds in cloud computing?

There are 4 main types of cloud computing: private clouds, public clouds, hybrid clouds, and multi-clouds. There are also 3 main types of cloud computing services: Infrastructure-as-a-Service (IaaS), Platforms-as-a-Service (PaaS), and Software-as-a-Service (SaaS).